This guide explains how to complete your enrollment request to import to WFS with Walmart Cross Border: Imports in Seller Center. It covers the information and documents you’ll need to enroll and step-by-step enrollment instructions.

As outlined in the WMSC Logistics Services, LLC Freight Terms and Conditions (“Terms and Conditions”) and in the Comprehensive Walmart Marketplace Program Retailer Agreement (“Agreement”), you are obligated to maintain information designated by Walmart as confidential. Please note that this content is considered such confidential information and therefore, may not be shared with any party without express permission by Walmart.

Before starting enrollment

You’ll need to validate your tax profile and billing services settings in Seller Center if you haven’t already done so by navigating to Settings > Financial Settings and checking both the Billing Services and Payment Info pages. If any of the information is incomplete, or there are notifications asking you to verify information, please provide or verify all necessary details.

If your tax profile or billing details are incomplete, you won’t be able to submit your enrollment request. Note that your Marketplace account must be in good standing.

In Seller Center go to Settings > Financial Settings, then:

Tax Profile. Verify that the tax profile for your company has been completed in Seller Center.

Billing Services. Verify that the billing details for your company have been provided and that you have a billing method on file.

You’ll also need the following information to complete enrollment:

Importer of record (IOR) company and contact information

IOR’s US Customs continuous bond number and bond expiry date.

Customs broker information including the broker's three digit filer code (or you can choose to use Walmart’s designated broker at time of enrollment).

Contact information for your enrollment point of contact

Compliance programs your IOR participates in (example: Trusted Trader)

Other government agency regulations your goods are subject to (example: dinnerware is subject to US Food and Drug Administration (FDA) regulation)

Power of Attorney (POA) signer details for the IOR

Corporate certification signer information where the IOR is a non-US resident importer (i.e. the company is not based in the US), or the IOR company type is a “limited partnership.”

If you're using a third party IOR, authorized signer contact information from your own company who can confirm the relationship with that IOR

Complete your enrollment request in Seller Center

Log in to Seller Center, then go to Settings > Shipping Profile > Walmart Imports. This will bring you to the welcome page.

Step 1 - Agree to the terms and conditions to get started

Read and agree to WMSC Logistics Services, LLC Freight Terms and Conditions.

Select Get started to begin the enrollment process.

Step 2 – Enter your enrollment contact information

We will use this information to share updates about your enrollment request.

Enter the point of contact for the person responsible for receiving enrollment updates.

Enter the email address we’ll send all enrollment updates to.

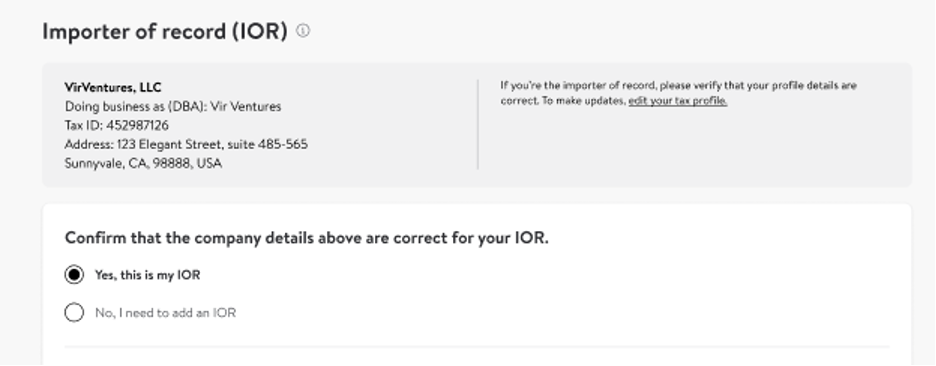

Step 3 – Provide your importer of record (IOR) details

Confirm that your company is the IOR or add information for a new IOR including the company type, import operations contacts, and confirmation that your IOR has a continuous bond on file with US customs. You can book shipments using the IOR once the IOR is approved.

- Provide the IOR’s continuous US customs bond number: To import with Walmart Cross Border: Imports, your IOR must have a US continuous customs bond set up with US Customs and Border Protection (CBP). The IOR’s continuous bond must have sufficient value to cover all the duties, taxes and fees for goods imported against the bond for a year. Walmart does not currently support the use of single transaction bonds.

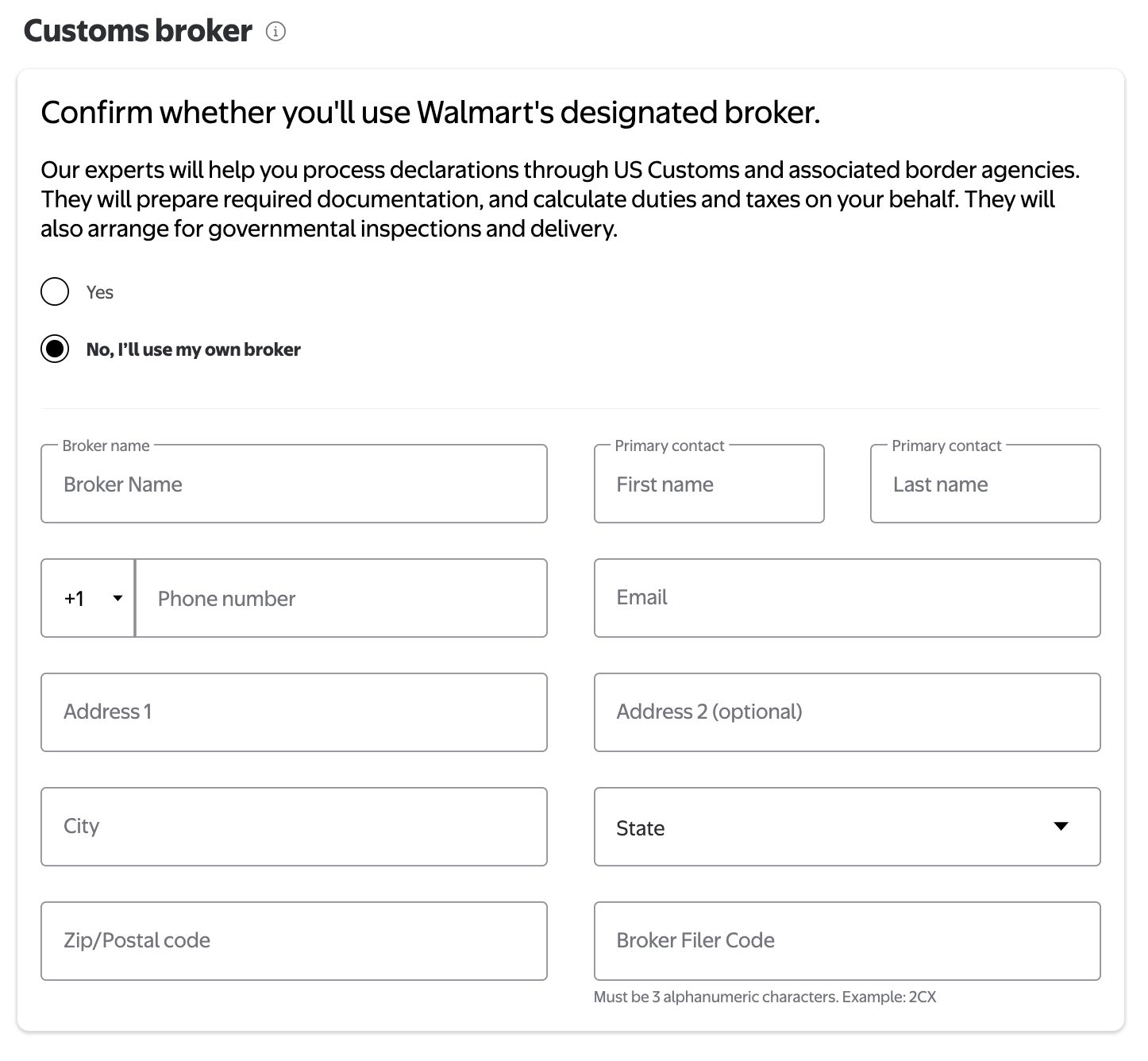

Step 4 – Add your customs broker

During this step, you can choose to use Walmart’s designated broker or add your own customs broker. Enter the required customs broker information in the corresponding fields.

If you choose to use Walmart’s designated customs broker, you’ll be asked to fill out additional documentation.

If you choose to use Walmart’s designated broker:

- Your IOR must have an Automated Clearing House (ACH) account set up to pay US Customs and Border Protection (CBP) for duties, taxes and fees.

- Note: The estimated duty is calculated at the destination port by CBP, so it will not be included in the original rate estimate or Negotiated Rate Arrangement (NRA).

Enter the six-digit ACH account Payer Unit Number (PUN) for the IOR that is set up with CBP. This number will be provided to the importer directly by CBP when they set up their ACH account.

The IOR can pay customs duties either directly with US Customs on a per shipment basis at the time of importation or participate in Periodic Monthly Statements (PMS). If the IOR participates in PMS, duties, taxes and fees for all your imports will be due once per month on the 15th business day of the month. Find more CBP ACH information here and CBP PMS information here and here. If you participate in PMS, check the box stating I participate in Periodic Monthly Statements (PMS).

Enter both primary and secondary financial contacts for your organization (those with oversight for the settlement of shipment duties, taxes and fees.)

Customs brokerage power of attorney (POA): If you choose Walmart’s designated broker, you’ll be required to complete their POA.

Third party waiver: When using Walmart’s designated broker, WMSC Logistics Services, LLC must be assigned as an agent that can handle brokerage-related matters, documentation, and information for shipments. The waiver assigns WMSC Logistics Services, LLC as an agent.

If you choose to use your own broker:

- Enter the broker's company name, address, primary contact details, and broker filer code. We will use this information to communicate with your broker for shipment clearance upon arrival.

NOTE: The broker's name must be the broker company name.

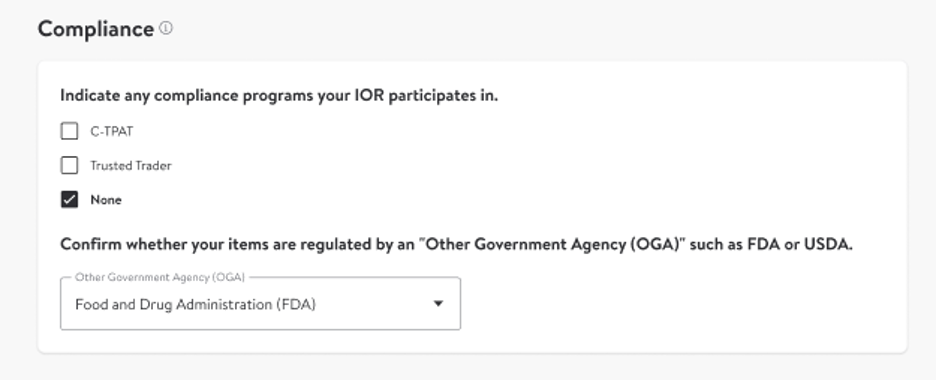

Step 5 – Enter your compliance information

Compliance programs: If your IOR is a participant in the Customs Trade Partnership Against Terrorism (C-TPAT) or Trusted Trader program, select the appropriate box in this section. If your IOR does not participate in either of these programs, select None.

Other Government Agency (OGA) regulated products: If any of the items you’re importing are subject to US other (or partner) government agency regulation, select the appropriate choice from the drop-down menu.

Step 6 – Add the IOR signatory party details

Enter the information for the signatory party for the IOR that is duly authorized to sign powers of attorney (POAs) and supporting documentation. The fields include the IOR signatory party’s name, role, phone number and email.

Corporate certification signer: To comply with regulations, in certain cases, a person other than the POA signer must certify that the person who signs the POA has the authority to do so on behalf of the company.

If your company is acting as the IOR, an officer of your company will be the corporate certification signer.

If your company is not acting as the IOR, an officer of the IOR company will be the corporate certification signer.

The corporate certification signer cannot be the same person as the POA signer.

There are additional documents that may be required depending on your situation:

If you use Walmart’s designated customs broker, you’ll also be instructed to sign a separate customs POA.

If the IOR company type is partnership or limited partnership, a partnership addendum will be required to list each partner, member, director and manager for the company in a partnership addendum. You will need to provide the details during enrollment. The partnership addendum will be sent for e-signature after enrollment.

If the IOR company type is limited partnership, you will need to upload the partnership agreement for the company. This document was created at the time the limited partnership was formed and will need to be provided directly by the limited partnership for upload during the enrollment process.

If your company is not acting as your IOR, please be prepared to provide a letter outlining the relationship between your company and the IOR during the document review phase. WFS will contact the onboarding point of contact provided in the enrollment workflow if this is required.

For more information on signatory parties, see the Involved parties and signatory parties guide.

Step 7 – Save and finish

Once you’ve reviewed all your enrollment information, select Submit to complete your enrollment request.

We’ll review your information and send documents to your signatory parties to collect their e-signatures. After all documents are signed, we’ll verify all the documentation.

We will send periodic updates on your enrollment status via email.

View and edit your enrollment information

After your enrollment is complete, you can go back to the Walmart Imports page to track the status of your enrollment and review the details you entered. If you’d like to edit your enrollment information, select Edit. Once you’ve updated your information, select Submit.

If you’ve already been approved and booked a shipment, editing approved enrollment information or signatory parties will not apply to shipments in progress. In progress shipments will proceed with the information provided at booking.

Editing approved info or parties may require new e-signatures and a new review. This may delay your ability to book new shipments pending finalization.

Ocean transportation services are provided by WMSC Logistics Services, LLC., a wholly owned subsidiary of Walmart Inc., licensed by the Federal Maritime Commission (FMC) as a Non-Vessel Operating Common Carrier (NVOCC). License number FMC OTI No. 032243NF